55+ Essential Tax-Related Survey Questions and Their Significance

Elevate Your Tax Understanding Through These Comprehensive Survey Questions

Trusted by 5000+ Brands

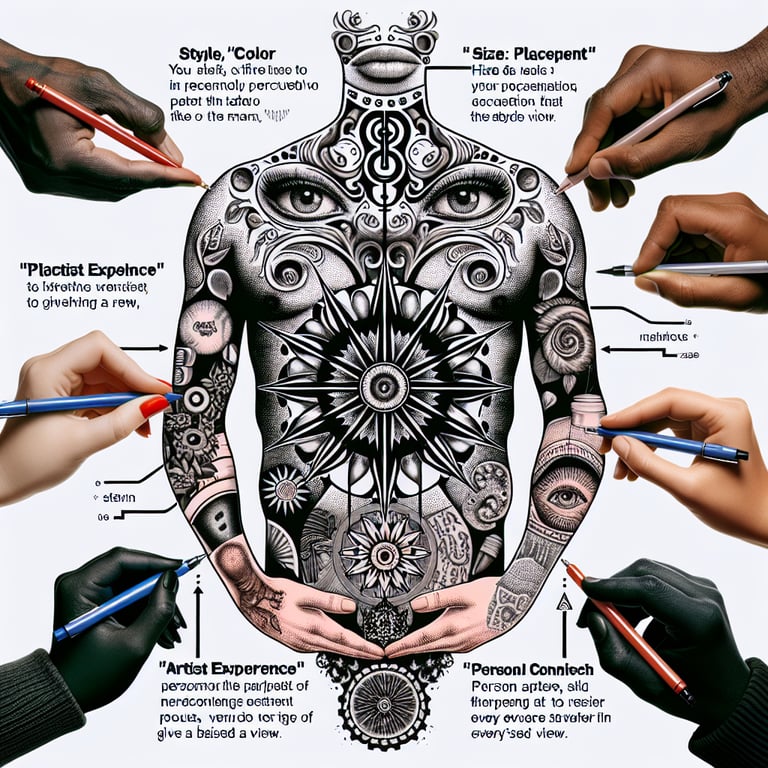

Unlocking Inked Insights: Crafting Effective Tattoo Perception Survey Questions

Understanding public views on tattoos begins with designing thoughtful survey questions. A study from the University of Houston highlights that tattoos have significantly gained societal acceptance, with nearly 30% of the population sporting them. As tattoos become more common, it's essential to delve into how they are perceived by different segments of society.

When creating your tattoo perception survey, start by defining your main research goals. Are you investigating societal acceptance of tattoos in professional settings? Examining cultural attitudes toward the significance of tattoos? Or assessing how tattoos influence perceptions of attractiveness or aggressiveness?

The nature of your questions will shape your findings. Research published on NCBI indicates that 76% of participants view tattoos as a form of self-expression, suggesting that questions about personal meaning can provide deep insights. Conversely, another study found a 40% bias against tattooed individuals in employment settings, highlighting the importance of exploring professional perceptions to uncover societal prejudices.

Effective surveys strike a balance between open-ended and closed-ended questions. While closed-ended questions yield quantifiable data, open-ended questions allow respondents to share unique perspectives, adding richness and depth to your analysis. To design your survey efficiently, consider using our form builder and explore various polls for inspiration.

Decoding the Ink: Pivotal Topics for Tattoo Perception Surveys

When designing tattoo perception surveys, certain themes consistently emerge as key areas of exploration. One major theme is the association of tattoos with deviance and criminality. A study referenced on JSTOR found that 52% of respondents link tattoos to deviance, highlighting a significant stereotype that your survey should investigate.

Another crucial topic is how tattoos are viewed in professional environments. Research from Indiana State University reveals that 58% of employers admit to harboring some bias against tattooed job applicants. This statistic underscores the necessity of including questions about professional acceptance in your survey.

The cultural importance of tattoos is also a vital area of focus. According to research published on NCBI, 67% of individuals with tattoos see them as symbols of personal identity or cultural heritage. This indicates that exploring the cultural and personal meanings behind tattoos can provide valuable insights into why people choose to get inked.

Furthermore, it's essential to consider how demographic factors such as age, gender, and cultural background influence tattoo perceptions. Studies show that older individuals and those from specific cultural backgrounds may have more negative views on tattoos. By incorporating demographic questions in your survey, you can achieve a more nuanced understanding of the factors shaping tattoo perceptions.

In summary, while tattoo art has been a form of self-expression for centuries, our perception of tattoos continues to evolve. By crafting well-designed surveys using our form builder and referencing various polls for effective question examples, you can gain deeper insights into this intriguing subject.

Tax Questions

Personal Tax Compliance Questions

This category focuses on the individual's understanding and compliance with tax laws. The objective is to measure the awareness level of the respondents about personal tax compliance, and how they manage their tax responsibilities.

-

Do you understand your obligations as a taxpayer?

This question helps to identify the level of knowledge individuals have about their tax obligations.

-

How frequently do you file your income tax returns?

The response to this question provides insight into the individual's compliance with tax deadlines.

-

Are you aware of the penalties for late tax filing or payment?

This question is crucial to assess the knowledge of respondents about the consequences of non-compliance.

-

Have you ever been audited by the tax authorities?

This question helps in identifying the respondents' experience with tax authorities and their compliance level.

-

Do you use tax software or hire an expert to file your tax returns?

This question gives an idea about the respondent's approach to filing taxes and whether they seek professional help or not.

-

Are you familiar with tax deductions and credits that you can claim?

This question assesses the knowledge of respondents about tax deductions and credits, which can lower their tax liability.

-

Do you keep records of your income and expenses for tax purposes?

This question provides information on the respondent's record keeping habits, which is essential for accurate tax filing.

-

Have you ever made a mistake in your tax return?

This question helps in understanding the common mistakes made by taxpayers while filing their tax returns.

-

Do you understand the difference between tax evasion and tax avoidance?

This question measures the understanding of respondents about the legality and ethics of tax planning strategies.

-

Do you feel that the tax you pay is fair?

This question provides insights into the respondent's perception of the fairness of the tax system.

Business Tax Compliance Questions

This category is designed to evaluate the understanding and compliance level of businesses with tax laws. The objective is to identify potential areas of improvement in tax education and compliance for businesses.

-

Is your business registered for tax purposes?

This question helps in identifying whether businesses are officially recognized by the tax authorities.

-

Do you file your business tax returns on time?

This question assesses the punctuality of businesses in filing their tax returns.

-

Do you understand the different types of taxes your business needs to pay?

This question gauges the understanding of businesses about their tax liabilities.

-

Are you aware of the tax deductions and credits that your business can claim?

This question measures the knowledge of businesses about tax deductions and credits that can reduce their tax burden.

-

Do you keep accurate records of your business income and expenses?

The response to this question can inform about the record keeping practices of businesses, which is crucial for accurate tax filing.

-

Have you ever been audited by the tax authorities?

This question sheds light on the level of scrutiny businesses have faced from tax authorities.

-

Do you use tax software or hire an expert to file your business tax returns?

This question provides information about whether businesses seek professional help for their tax filing or not.

-

Are you familiar with the penalties for late tax filing or payment?

This question is essential to assess the awareness of businesses about the consequences of non-compliance with tax laws.

-

Do you believe the tax system is fair to businesses like yours?

This question can reveal perceptions about the fairness of the tax system towards businesses.

-

Have you ever made a mistake in your business tax return?

The response to this question can help identify common mistakes made by businesses in their tax returns.

Tax Policy Understanding Questions

This category aims to assess the understanding of individuals and businesses about tax policy. The responses will provide insights into how well the respondents are informed about the tax policy and its implications.

-

Do you understand the basic principles of the current tax policy?

This question evaluates the level of understanding of respondents about the basic tenets of tax policy.

-

Are you aware of any recent changes in tax laws that affect you or your business?

This question measures awareness of respondents about recent tax law changes and their implications.

-

Do you understand how taxes are used to fund public goods and services?

This question gauges the understanding of respondents about the role of taxes in financing public expenditure.

-

Are you familiar with the concept of progressive, regressive, and proportional taxation?

This question measures the understanding of respondents about different tax systems and their implications.

-

Do you believe that the current tax policy is effective in reducing income inequality?

The response to this question provides insights into the perceptions of respondents about the role of tax policy in addressing income inequality.

-

Do you understand how tax breaks and incentives work?

This question assesses the knowledge of respondents about tax breaks and incentives and their role in promoting economic activities.

-

Do you believe that the current tax policy encourages economic growth?

This question gauges the perceptions of respondents about the impact of tax policy on economic growth.

-

Are you familiar with the concept of tax havens and their implications?

This question measures the understanding of respondents about tax havens and their role in tax evasion and avoidance.

-

Do you believe that the tax system should be simplified?

The response to this question provides insights into the perceptions of respondents about the complexity of the tax system and the need for simplification.

-

Do you understand the concept of tax neutrality and its implications?

This question gauges the understanding of respondents about tax neutrality and its role in economic decision making.

Tax Education and Awareness Questions

This category is designed to measure the level of tax education and awareness among individuals and businesses. The responses will help identify potential gaps in tax education and awareness that can be addressed through targeted interventions.

-

Have you ever taken a course or attended a workshop on taxes?

This question assesses the level of formal tax education among respondents.

-

Are you aware of any resources where you can get reliable information about taxes?

This question measures the awareness of respondents about resources for tax information.

-

Do you feel confident about your ability to understand and manage your tax obligations?

The response to this question provides insights into the self-perceived competence of respondents in handling their tax responsibilities.

-

Do you believe that tax education should be a part of the school curriculum?

This question gauges the perceptions of respondents about the importance of tax education in schools.

-

Do you know where to go or whom to ask if you have a question or problem related to taxes?

This question measures the awareness of respondents about the availability of help for tax-related issues.

-

Do you understand tax-related terms and jargon?

This question assesses the level of understanding of respondents about tax terminology.

-

Do you regularly update your knowledge about tax laws and regulations?

The response to this question can inform about the commitment of respondents to staying informed about tax laws and regulations.

-

Do you believe that tax education can help in improving tax compliance?

This question gauges the perceptions of respondents about the role of tax education in promoting tax compliance.

-

Are you aware of the role of taxes in society and the economy?

This question measures the understanding of respondents about the role of taxes in society and the economy.

-

Do you understand the process of tax collection and administration?

This question assesses the knowledge of respondents about the process of tax collection and administration.

Tax Reform Opinion Questions

This category is aimed at understanding the opinions of individuals and businesses on tax reform. The responses will provide valuable insights into the perceptions and expectations of respondents about tax reform.

-

Do you believe that the current tax system needs reform?

This question gauges the perceptions of respondents about the need for tax reform.

-

What aspects of the tax system do you think need the most reform?

The response to this question can inform about the areas of the tax system that respondents find most problematic or in need of improvement.

-

Do you believe that tax reform should focus on reducing tax rates or broadening the tax base?

This question measures the preferences of respondents about the direction of tax reform.

-

Do you think that tax reform should aim at simplifying the tax system?

This question gauges the perceptions of respondents about the complexity of the tax system and the need for simplification.

-

Do you believe that tax reform should be used to address income inequality?

This question measures the perceptions of respondents about the role of tax reform in addressing income inequality.

-

Do you think that the process of tax reform should be transparent and inclusive?

The response to this question provides insights into the expectations of respondents about the process of tax reform.

-

Do you believe that tax reform should prioritize economic growth?

This question gauges the perceptions of respondents about the role of tax reform in promoting economic growth.

-

Do you think that tax reform should include measures to combat tax evasion and avoidance?

This question measures the perceptions of respondents about the importance of addressing tax evasion and avoidance in tax reform.

-

Do you believe that the benefits of tax reform outweigh the costs?

The response to this question can inform about the perceived cost-benefit analysis of respondents about tax reform.

-

Do you think that the outcome of tax reform should be revenue neutral?

This question measures the perceptions of respondents about the fiscal implications of tax reform.